Boosting Investments with PROINVERSIÓN

Peru has become one of the favorite countries for foreign investors in the last decades due to the stability of its economy despite the social and political conflicts compared to other Latin American countries.

Definition and Registration of Foreign Investment

Foreign investment is the contributions from abroad for income-generating economic activities, according to the modalities established in Article 1 of Legislative Decree No. 662. These investments must be registered before PROINVERSIÓN, which is the Competent National Agency.

Benefits and Rights of Foreign Investors

Article 7 of the above-mentioned law entitles the holder to transfer abroad in freely translatable foreign currency after paying taxes without prior authorization from the Central Government or decentralized bodies. This guarantee covers the transfer of funds and does not require governmental approval for its performance, in addition to include:

- The entire amount of its capital from investments, including the sale of shares, equity stakes or ownership rights, capital reduction, or partial or complete liquidation of companies; and.

- The entire amount of dividends or proven net profits from its investment, as well as the considerations for the use or enjoyment of goods located in the country, and of royalties and considerations for the use and transfer of technology, including any other component of industrial property authorized by the Competent National Body.

Tax Stability and Requirements for Investors

According to the provisions of Article 10 of D.L N° 662, after filing the Preliminary Investment Form before the Competent National Body, such body, on behalf of the State, can negotiate agreements to ensure the following rights to investors within twelve (12) months after obtaining the enabling title:

- Maintenance of the stability of the tax regime in force when the agreement is entered into.

Due to the stability guaranteed in the tax regime, the foreign investor will not be affected by the income tax corresponding to the company receiving the investment and that related to the attributed profits and/or dividends distributed in its favor. The rate applied to the foreign investor will not exceed the rate established in the corresponding agreement. In case of an increase in the company’s income tax, the rate affecting the foreign investor will be reduced to ensure the equality between the company’s profit, finally available to this, and the insured amount.

Conditions and Benefits Depending on Investment Amounts

Only those foreign investors committed to comply, within a maximum term of two years from the date of entering into the respective agreement, with any of the following conditions, may benefit from the regime established in Article 10 above:

- To contribute in cash, through the National Financial System, to the capital of an existing company or one about to be established, subject to Peruvian law, or to carry out risk investments formalized with third parties for an amount not less than US$ 2’000,000.00 (Two million U.S. dollars); or,

- To contribute in cash, through the National Financial System, to the capital of an existing company or about to be established, subject to Peruvian law, or to carry out risk investments formalized with third parties for an amount of not less than US$ 500,000.00 (Five hundred thousand United States dollars), provided that:

- The investment resulted in the direct creation of over twenty permanent jobs or

- The investment directly generates foreign exchange income for an amount not less than US$ 2’000,000.00 (Two million U.S. dollars) in exports during the three years following the signing of the agreement.

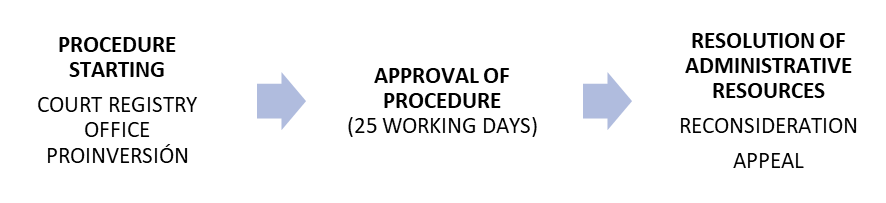

Procedures for the Investment Application

PROINVERSIÓN provides the procedures to be followed for the application process according to the type of Foreign Investment for all cases, being the following:

- The forms, annexes, and copies must be countersigned by the legal representative.

- If the Accounting Entries and the Bank Proofs are inserted in the Public Deed of Capital Increase, a copy thereof will suffice.

- If the registration is related to the compliance with a Legal Stability Agreement, the following must be filed: i) Legalized copy of the Accounting Entry of Capitalization of the Daily Book, ii) Original proof or legalized copy of the document certifying the contribution was from abroad through the National Financial System, and iii) Testimony of the Public Deed of Capital Increase and Modification of Bylaws, registered in the corresponding registry.

These are the most important aspects considered. For further details on the Foreign Investment Registry scope, the foreign investor should review the entire regulation of the D. L No. 662 and, for the consultation of the application according to the type of foreign investment, contact registro@proinversion.gob.pe